Over 400 Assignments Completed for More than 100 Clients

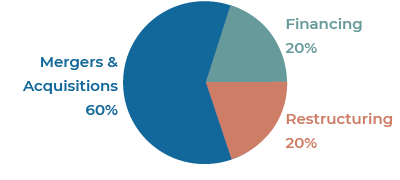

Founded in 1990, B&Co provides investment banking services to electricity generators in the United States. The firm has played a key role in financing, selling, purchasing, restructuring, or appraising more than 350 power projects with a total value of over $10 billion. Clients include independent power companies, lenders, industrial companies, utility affiliates and regulated utilities. B&Co has experience with biomass, coal, geothermal, hydro, natural gas, solar, wind, and other methods of power generation.

Founded in 1990, B&Co provides investment banking services to electricity generators in the United States. The firm has played a key role in financing, selling, purchasing, restructuring, or appraising more than 350 power projects with a total value of over $10 billion. Clients include independent power companies, lenders, industrial companies, utility affiliates and regulated utilities. B&Co has experience with biomass, coal, geothermal, hydro, natural gas, solar, wind, and other methods of power generation.

Mergers & Acquisitions

B&Co provides advice to buyers, sellers and other participants in power project related transactions. Results for clients include higher value, better non-price terms and more efficient use of staff.

- Advised on restructuring and sale of troubled 30 MW project.

- Prepared, auctioned and sold 75 MW biomass portfolio.

- Evaluated, marketed and sold 30 MW biomass-fired project.

- Analyzed, auctioned and closed sale of $20 MM gas-fired facility.

- Advised lessor during renewal of lease on 75 MW biomass and coal fired project.

- Auctioned site lease rights for 600 MW gas-fired facility.

- Arranged meteorological study and lease options on two 100 MW wind projects.

- Obtained multiple offers and closed sale of electric utility serving Prudhoe Bay, AK.

- Evaluated, marketed and sold a $30 MM LC liability for a biomass project.

- Analyzed, auctioned and sold a portfolio of six hydroelectric projects.

- Provided a Fairness Opinion to a publicly-traded company in support of its purchase of a 115 MW project.

Financing

B&Co arranges equity and non-recourse debt financing for development, construction, repowering, acquisition and recapitalization of power projects.

- Managed competitive debt and equity offerings to fund a 140 MW peaking project.

- Arranged $25 MM replacement letter of credit to support tax exempt bonds.

- Arranged a funding partner to complete a development stage 80 MW wind project.

- Arranged a funding partner to complete a development stage 160 MW gas project.

Restructuring

B&Co advises clients on capital structure, restructuring repayments, breaking swaps and portfolio rationalization.

- Advised lender on exposure concerning a distressed 30 MW hydroelectric facility.

- Advised bank group on restructuring a distressed $600 MM coal project financing.

- Created pre-payment plan to minimize $20 MM swap breakage costs.

- Advised bank group on rescheduling minimum principal payment, mandatory pre-payments and swap breakage concerning a 29 MW natural-gas fired facility.